Freedom from the chain - a change of direction for global graphite anode supply

The headwinds for the current global supply of graphite anode for electric vehicle batteries are undoubtedly strengthening.

Demand for graphite, which fills a hefty 25% to 30% of the weight of an electric vehicle’s (EV) lithium-ion battery, is growing at an eye-watering pace, driven largely by an increasing appetite for electrified transport. In the first half of 2022, 4.2 million EVs were sold worldwide; a 63% increase on the first half of 2021.

However, the supply chain for graphite is long, with 90% of the world's anode production coming from China. That supply chain is prone to disruption, including from the COVID-19 pandemic, but equally from other policy measures in China. The nation is also feeding its own rapidly growing battery capacity, set to increase by 220% to 2030. Meanwhile, prices of synthetic graphite are set to rise, compounded by oil supply pressure, recent Chinese synthetic graphite plant shutdowns, and stalled mine projects.

Unsurprisingly, governments of other growing EV regions are investing in bringing battery raw material supply chains onto home shores. As in business, it is risky to sole source.

Inevitable bottlenecks from these growing pressures on an already geopolitically uncertain supply chain will give European and US battery manufacturers little to work with. Downstream, consumers and the world’s transport decarbonisation and climate goals will ultimately pay the price.

Made in America?

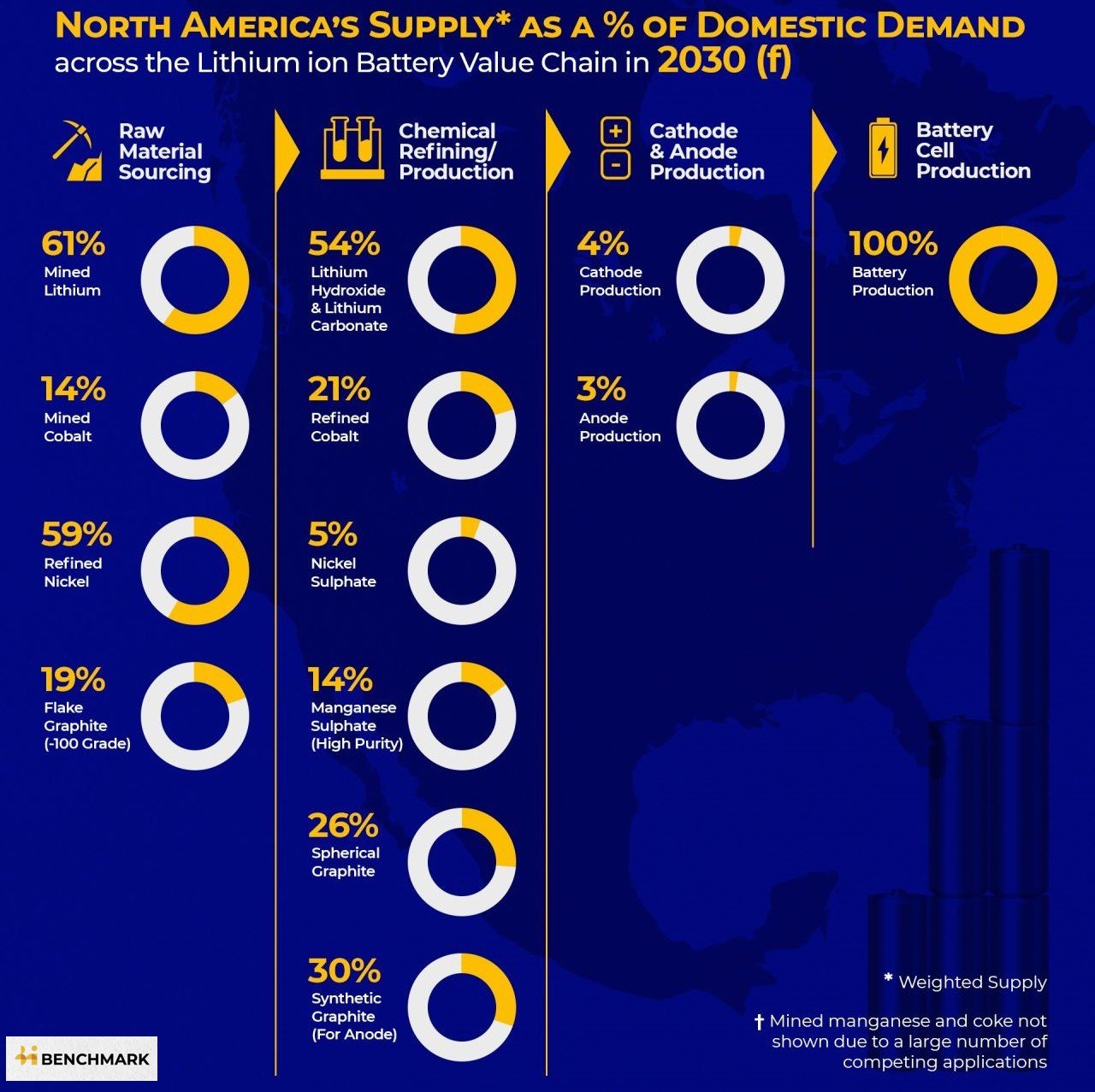

The Inflation Reduction Act, announced in 2022, highlighted the stark reality that no American EV manufacturer can claim a local supply chain for battery anode material.

The act mandates EV manufacturers to source 50% of raw materials by 2024 and 100% by 2029. Already, the federal government has placed significant funds in ensuring battery materials, including graphite, will be processed in domestic facilities.

Currently, the US controls just 0.27% of global graphite manufacturing, while battery capacity is forecast to increase by 575% to 2030. Back in late 2021, leading EV producer Tesla, in a bid for a tariff waiver, said only mainland China could provide the quantity of artificial graphite it needs to make its batteries in the US.

Unfortunately for Tesla, China is not on the US preferred suppliers list – and synthetic graphite has been added to the list of critical materials by the US Department of the Interior.

The EU: digging for self-sufficiency

In Europe, the fastest-growing region for new EV lithium-ion battery capacity outside China, a similar legislative scene is playing out, with the proposed European Critical Raw Material Act and Carbon Border Tax.

Unlike the US, Europe has domestic graphite mines. But, globally, nearly 100 extra graphite mines will be needed to meet demand for anode materials. Europe will need a significant slice of that to feed its battery making capacity, forecast by Benchmark Mineral Intelligence to increase more than sixfold to 789.2 GWh by 2030.

And, with the significant environmental and social impact of mining taken more seriously than in the past, the prospect of relying on an abundant, local, natural graphite supply is already hampered by delays to mine permitting – most recently in Sweden. This slowed pace in mining will only serve to deepen reliance on China and reinforces that while localised production is important, it must also be environmentally sound.

A sustainable solution to free the chain - CarbonScape biographite

CarbonScape answers both the supply chain and the decarbonisation challenges with sustainable biographite anode material, made locally from renewable feedstocks.

Working with commercial partners in North America and Europe, our patented biographite technology will remove battery makers’ reliance on fossil fuels, mining and existing graphite supply chains.

Because it can be used anywhere feedstocks are available, our technology can realistically reduce a graphite anode supply chain from 25,000km to a 400km train journey, or less - even right at an American or EU gigafactory’s door.

Our proprietary process is also net carbon negative. Unlike polluting synthetic and mined fossil graphites, we take waste streams from the timber (lumber) and forestry industries as a biomass feedstock to produce battery-grade biographite. This process is continuous and fast, taking just hours, compared to the weeks it takes to make traditional synthetic graphite.

The lower emissions associated with localised production, coupled with our environmentally friendly processes, meet US and EU legislative CO₂ emissions targets, which traditional synthetic and natural graphites never will. Even when locally sourced, they will always carry significant carbon footprints, including grid emission factors in both regions.

Clean, affordable and abundant opportunity

CarbonScape biographite technology can be located in regions that offer the cleanest energy mixes, and the most affordable power and wood waste prices.

For Europe and the US, that offers widespread opportunity. In the EU, 75% of usable feedstock is located in 10 countries, and 92% across 20 countries. In North America, 13 states or provinces have enough wood waste availability, at favourably low prices. This includes sawmill chips, sawdust and shavings, and logging residues.

To meet 10% (90,000 tonnes per year) of US graphite anode market demand by 2030, biographite production would only use 0.3% of North America’s generated wood waste. In Europe, capturing 5% (100,000 tpy) of market demand would see around 1% of wood waste used.

Much is currently fired in biomass boilers, sending the carbon back into the atmosphere, instead of fixing it into the anodes of lithium-ion batteries and freeing the transport sector from fossil fuel emissions.

There is huge untapped potential to use this resource.

We are now engaging with commercial partners for scaling up production of our world-first biographite anode in North America and Europe.

To be part of this important mission to localise, decarbonise and secure lithium-ion battery anode material supply chains with climate-positive biographite technology, talk to us now.

Forestry industry data source: O’Kelly Acumen AB