Graphite anode - natural vs synthetic or… biographite?

The true environmental impact of lithium-ion batteries, particularly in the electric vehicle industry, is under close global scrutiny and debate.

And so it should be.

Graphite, comprising 25% to 30% of a battery, is one of the largest carbon dioxide emitters in the battery raw material market, and is heavily dependent on the fossil fuel industry.

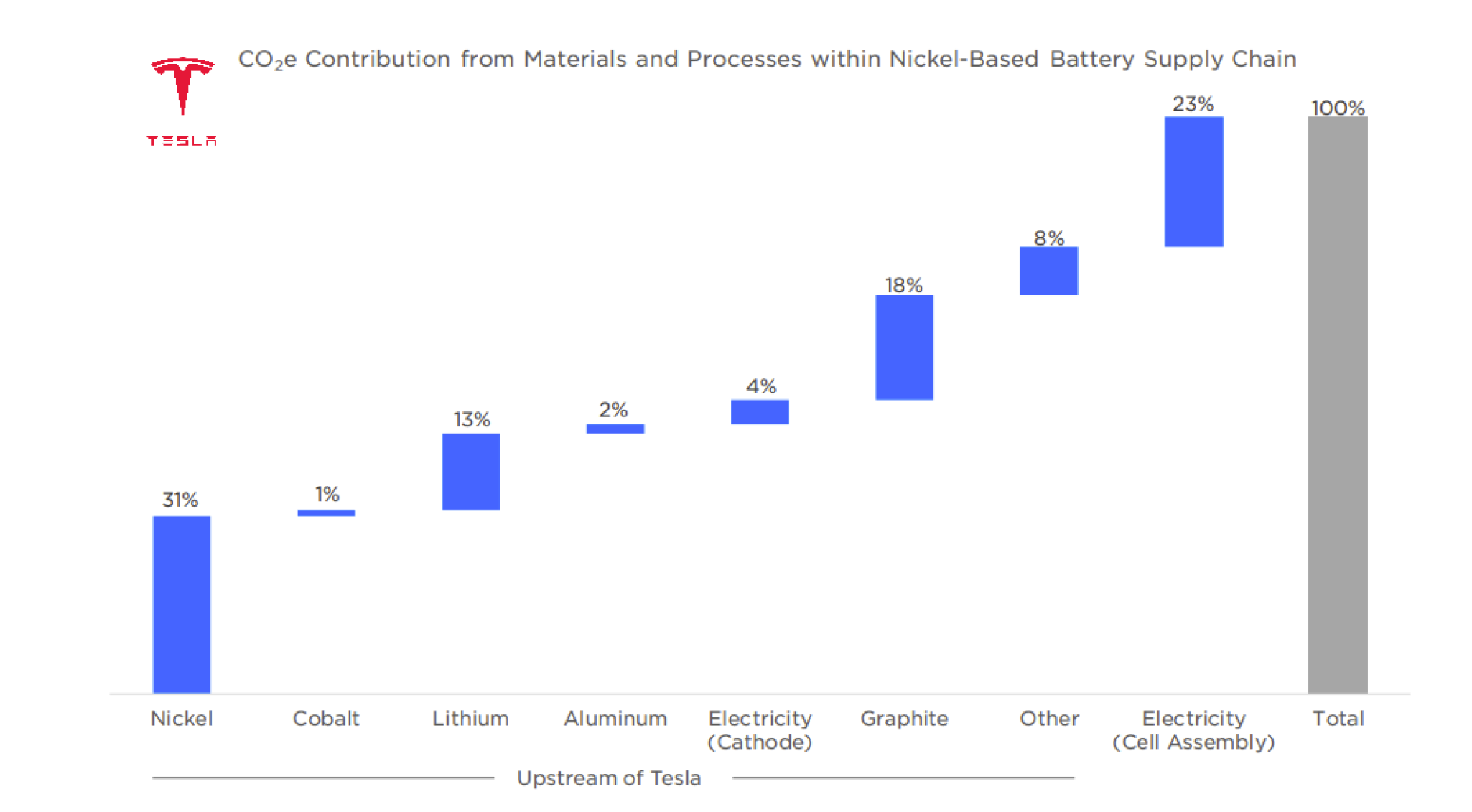

The world’s largest electric vehicle (EV) manufacturer, Tesla, named graphite as one of the main contributors of CO₂ in their nickel-based battery supply chain – second only to nickel, as shown in this graph from Tesla’s Impact Report 2021.

The synthetic graphite dilemma

Favoured by EV and battery manufacturers for its consistency and performance, synthetic graphite dominates the anode supply chain. Made from coke – the carbon that’s left over from oil and coal refining – this fossil fuel is heated to 2500-3000°C in a hugely energy intensive process, with massive CO₂ emissions.

Based on our discussions with a global EV manufacturer, CO₂ emissions associated with synthetic graphite anode are up to 25 CO₂e: the number of tonnes of CO₂ emitted for every tonne of anode produced.

When natural isn’t natural

Natural graphite isn’t as natural it sounds.

A finite resource, natural graphite is ancient fossil carbon that is mined, then shipped globally – usually to China – to be processed and refined for use in lithium-ion battery anode. It’s a long, complicated, and polluting journey towards green energy storage: anode produced by natural graphite is up to 14 CO₂e, according to a benchmarking exercise by a leading life cycle analysis (LCA) practitioner.

While natural graphite appears to provide a reduction in CO₂ emissions compared to synthetic, it has not yet gained a significant market share in the anode space. That’s because natural graphite anode producers are yet to convince EV and battery manufacturers they can overcome concerns around long-term product consistency and in-battery performance.

The problem is perhaps best captured by Grayson Hoteling on Better Batteries, where he explains that China, the world’s largest natural and synthetic graphite producer, uses coal to power most of its manufacturing processes. The US, too, relies on fossil fuels for graphite production, or importation, to make green EVs.

“Both types of graphite production… as they stand are in direct contradiction to the mission of electric vehicles,” he writes.

Below zero: A net negative emission biographite

Carbon neutral is not enough. We need to go below zero.

This is only possible by investing in carbon negative technology, not settling for carbon neutral.

CarbonScape biographite is the world’s only net negative CO₂ emission anode material for lithium-ion batteries. Made from renewable forestry and timber industry byproducts, our biographite locks away carbon that would otherwise be released into the atmosphere.

The patented CarbonScape process can be used anywhere in the world where biomass feedstock is available. This means transport emissions associated with the long supply chains of natural and synthetic graphite are hugely reduced, if not eliminated.

As PwC has put it, environmental, social and corporate governance (ESG) investment is more than ticking boxes: “It’s about making a difference – for your business and our world. Creating sustained outcomes that drive value and fuel growth, whilst strengthening our environment and societies.”

Read more: Better Batteries